Brett’s best yet! Bank 4.0 is a tour de force that opens your eyes to what already exists, and your mind to the imminent possibilities.

A must read..

INTERVIEWS AND PODCAST

WHAT OTHERS ARE SAYING ABOUT THIS BOOK

“From Bank 2.0 to 4.0, Brett has not only been tremendously accurate in predicting where the ball is going in the future of money, but, more importantly, he’s been actively shaping how it will get there. Here’s a tip: don’t bet against him.”

— Alex Sion

co-founder Moven and GM – Mobile Channel, JP Morgan Chase

“Brett King has done it again with his latest volume. Bank 4.0 pushes us to deconstruct the mouse trap we call a bank, wipe the digital slate clean, and re-imagine banking for the year 2050 by focusing on first principles and customer needs. Drawing on examples from the developing world, King paints a compelling vision for how digitally-native banking can be a winning strategy — and an inclusive one.”

— Jennifer Tescher

President & CEO of the Center for Financial Services Innovation

“In Bank 4.0, Brett does it again and moves our thinking along in financial services from rethinking the bank model as discussed in his previous books to pointing to how to build the new model using first principles thinking. It’s another ground-breaking book and brings together not only his own thoughts, but the thinking of many of us who are trying to create the next generation of finance using technology, or FinTech if you prefer. Anyone involved in finance, technology, money and banking who doesn’t pick up this book is missing the key to their future and, as a result, might not have one.”

— Chris Skinner

Bestselling Author of Digital Human, Chairman of The Financial Services Club

“Brett’s best yet! While one may not agree with all his assertions, the fundamental insights -that banking needs to be reimagined from first principles, that it must be embedded into daily lives, that data, AI and voice are game changers in this regard – cannot be argued against. Bank 4.0 is a tour de force that opens your eyes to what already exists, and your mind to the imminent possibilities. A must read..”

— Piyush Gupta

Group Chief Executive Officer at DBS Bank

“As the banking industry continues to disrupt at an ever-accelerating pace, this unputdownable book paints a future that is both exciting and inspiring.

This is Brett, the King of futurism, at his compelling best! Speaking as a banker, you must read Bank 4.0”

— Suvo Sarkar

Senior EVP and Group Head of Retail Banking and Wealth Management, EmiratesNBD

“Banking is being disrupted on a global basis and Brett’s book helps to navigate through these rapid transformations. A must read in the new era of banking.”

— Valentin Stalf

CEO and co-founder of N26

“Yet again, Brett King brings together some of the most knowledgeable and experienced figures in global FinTech for this authoritative guide to the very latest mega trends.”

— Anne Boden

CEO and Founder of Starling Bank

“‘I don’t think anyone else on the planet has Brett’s ability to piece together what is happening around the globe and forecast the future of banking. A thoroughly researched, data-driven analysis of the future of banking, from someone who has ‘walked the walk’”

— Anthony Thomson

Founder & former chairman Atom Bank and Metro Bank. Co-author ‘No small change

“Two years ago on stage in Beirut, I called Brett King ‘the King of Ban-King’ and I stand by every word. This book continues his canon on the subject of where banking is going next. Everybody in a FinTech company should read it, everybody in traditional banking HAS to read it or they will be without a business in five years.”

— Monty Munford

Founder of Mob76, SXSW emcee and public speaker, writing for The Economist, BBC, Forbes and Fast Company.

“The organizations we develop partnerships with know that our customers are in the driver’s seat. We’re innovating for them and that’s non-negotiable. Brett King and Moven understood that from day one, and Bank 4.0 is his manifesto.”

— Rizwan Khalfan

EVP, Chief Digital and Payments Officer at TD Bank Group

Amazon Bestselling Author | Speaker at Wired, TED, Economist, Singularity University | Industry Commentator on Fox, CNBC, MSNBC, and BBC | Innovator of the Year | Radio Show Host on Voice of America and WVNJ

CRITICAL ACCLAIM FOR AUGMENTED

BRETT’S DISRUPTIVE FINTECH

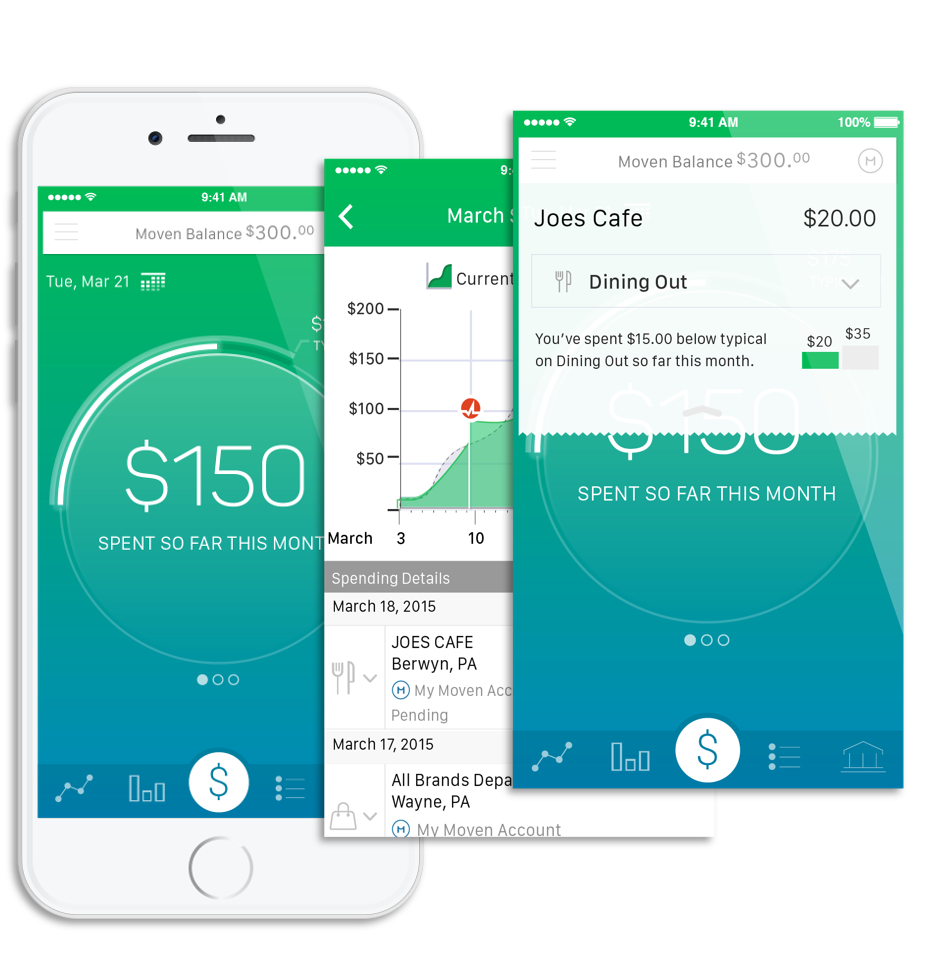

In 2011, Brett King co-founded Moven as the first U.S. direct to consumer neobank to offer account opening via a mobile app. The app’s engaging design helps customers spend, save and live smarter. This innovative approach led to creating global demand from banks to offer Moven technology to their clients, resulting in the firm’s transformational Moven Enterprise offering.

To learn more visit moven.com or movenenterprise.com.

MORE BOOKS

FROM BRETT KING

Augmented

Life In The Smart Lane

Welcome to the AUGMENTED AGE. Super powers. Super cities. Super vehicles. Super robots. Technology is about to change everything in your life. Whether you’re scared, excited, or both, you need to read this awesome roadmap of the future that Brett King has created. Those who can anticipate the future can thrive in it.

Available now, Order on

Augmented

Augmented

Life in the Smart Lane

Available now, Order on

Bank 3.0

Why Banking Is No Longer Somewhere You Go,

But Something You Do

The first edition of BANK 2.0 – #1 on Amazon’s bestseller list for banking and finance in the US, UK, Germany, France, and Japan for over 18 months—took the financial world by storm and became synonymous with disruptive customer behaviour, technology shift, and new banking models.

Available now, Order on

Bank 3.0

Bank 3.0

Why Banking Is No Longer Somewhere You Go, But Something You Do

Available now, Order on

Breaking Banks

The Innovators, Rogues, and Strategists

Rebooting Banking

“In the next 10 years, we’ll see more disruption and changes to the banking and financial industry than we’ve seen in the preceding 100 years”—Brett King. This is a unique collection of interviews take from across the global Financial Services Technology (or FinTech) domain detailing the stories, case studies, startups, and emerging trends that will define this disruption.

Available now, Order on

Breaking Banks

Breaking Banks

The Innovators, Rogues, and Strategists Rebooting Banking

Available now, Order on

Branch Today, Gone Tomorrow

The Case For The Death of Branch Banking

In the wake of the global financial crisis, retail bankers face another equally challenging shift to their business in the near term – the demise of the branch. In the UK, one bank branch has closed everyday since 1990. In the US, transaction volume in-branch will be down almost 60% between the period 2006- 2015.

Available now, Order on

Branch Today, Gone Tomorrow

Branch Today, Gone Tomorrow

The Case For The Death of Branch Banking

Available now, Order on

Bank 2.0

How Customer Behavior And Technology

Will Change The Future of Financial Services

The financial crisis is just beginning for retail institutions. Ninety to ninety-five per cent of bank transactions are executed electronically today. The Internet, ATMs, call centres and smartphones have become mainstream for customers.

Available now, Order on

Bank 2.0

Bank 2.0

How Customer Behavior And Technology Will Change The Future of Financial Services

Available now, Order on